Moderator: 3ne2nr Mods

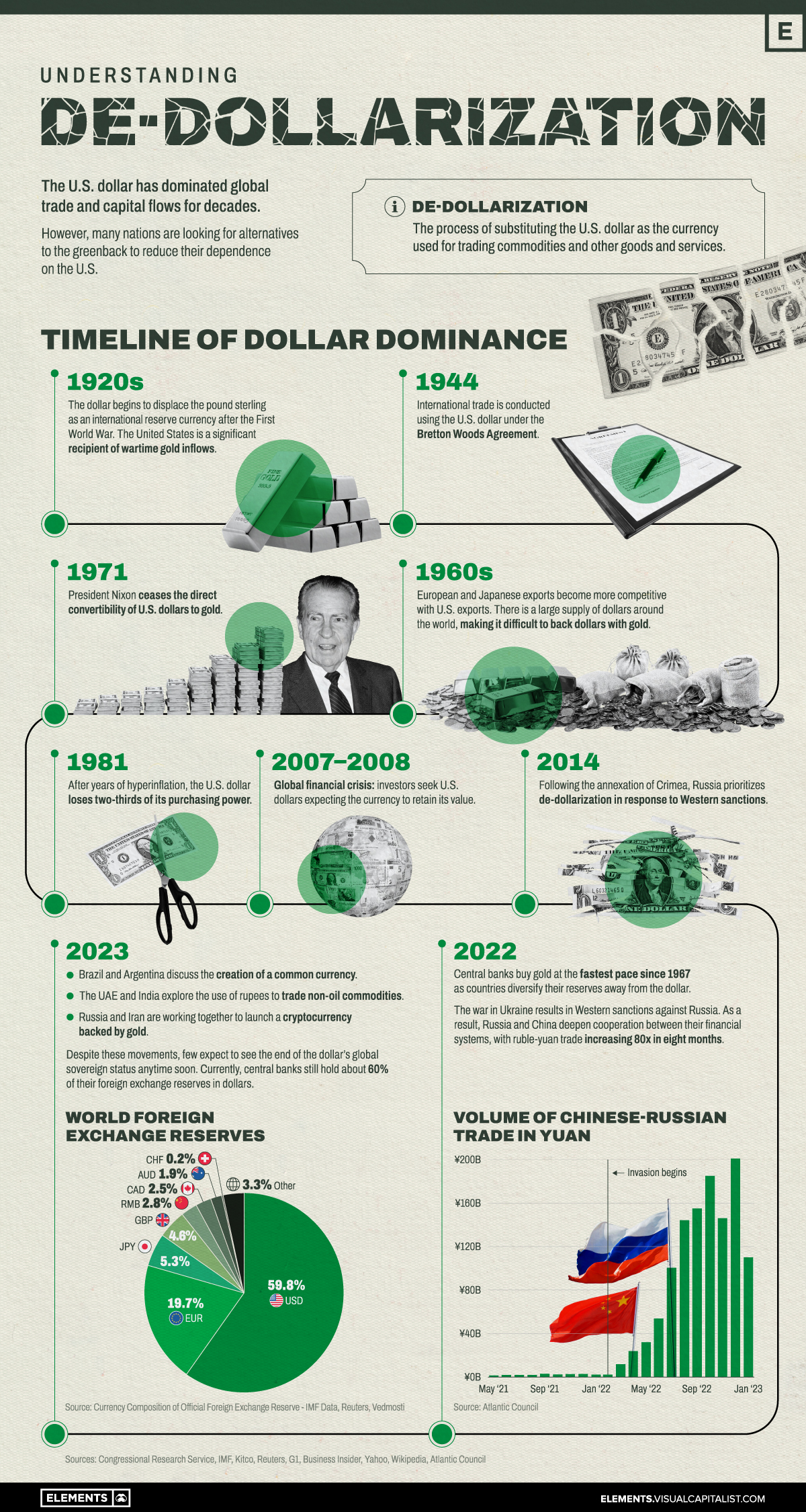

toyolink wrote:The BRICS initiatives are well on the way and very little is being discussed on the impact this will have on countries like T&T. Considering that our reserves are held in US$ and our currency is pegged to US$ the new geopolitical war may

mean serious consequences are on the horizon and no strategic planning seems to be on the agenda.

We seem to be asleep at the wheel.

redmanjp wrote:would any of this affect local housing prices? might be looking to buy a house in the next year but could put it off if the value might drop.

toyolink wrote:No question about it we are living in times of great peril, the question remains 'is there anything we can do to mitigate our exposure?'.

redmanjp wrote:would any of this affect local housing prices? might be looking to buy a house in the next year but could put it off if the value might drop.

shaneelal wrote:May assist BRICS.

Saudi Arabia's petro-dollar exit: A global finance paradigm shift

The financial world is bracing for a significant upheaval following Saudi Arabia's decision not to renew its 50-year petro-dollar deal with the United States, which expired on Sunday, 9 June, 2024.

The lapsed security agreement - signed by the United States and Saudi Arabia on 8 June 1974 - establishes two joint commissions, one on economic co-operation and the other on Saudi Arabia's military needs, and was said to have heralded an era of increasingly close co-operation between the two countries.

American officials at the time expressed optimism that the deal would motivate Saudi Arabia to ramp up its oil production. They also envisioned it as a blueprint for fostering economic collaboration between Washington and other Arab countries.

The crucial decision to not renew the contract enables Saudi Arabia to sell oil and other goods in multiple currencies, including the Chinese RMB, Euros, Yen, and Yuan, instead of exclusively in US dollars. Additionally, the potential use of digital currencies like Bitcoin may also be considered.

https://www.bizcommunity.com/article/sa ... ft-670911a

shaneelal wrote:^Another article

U.S.-Saudi Petrodollar Pact Ends after 50 Years

https://www.nasdaq.com/articles/us-saud ... r-50-years

nasdaq.com domain owned by

Registrant Organization: The Nasdaq Stock Market, Inc.

SuperiorMan wrote:shaneelal wrote:^Another article

U.S.-Saudi Petrodollar Pact Ends after 50 Years

https://www.nasdaq.com/articles/us-saud ... r-50-years

nasdaq.com domain owned by

Registrant Organization: The Nasdaq Stock Market, Inc.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

I'm wondering why somewhere like AP or Reuters or at least someone reputable didn't publish something like this or ever id about the pact.

SuperiorMan wrote:shaneelal wrote:^Another article

U.S.-Saudi Petrodollar Pact Ends after 50 Years

https://www.nasdaq.com/articles/us-saud ... r-50-years

nasdaq.com domain owned by

Registrant Organization: The Nasdaq Stock Market, Inc.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

I'm wondering why somewhere like AP or Reuters or at least someone reputable didn't publish something like this or ever id about the pact.

Dizzy28 wrote:BRICS Summit underway in Kazan, Russia.

India the real OG in this.

Their 155mm shells are in Ukrainian hands

They are the largest purchaser of under-priced Russian oil

They still buy 70% of arms from Russia while being a member of the Quad to counter Chinese influence

They are building a massive port in Iran while supplying Israel with Arms.

Zionists pretend to like Indians but they hate everything that is not whiteDizzy28 wrote:BRICS Summit underway in Kazan, Russia.

India the real OG in this.

Their 155mm shells are in Ukrainian hands

They are the largest purchaser of under-priced Russian oil

They still buy 70% of arms from Russia while being a member of the Quad to counter Chinese influence

They are building a massive port in Iran while supplying Israel with Arms.

Return to “Ole talk and more Ole talk”

Users browsing this forum: Google Adsense [Bot] and 58 guests